Today we closing out the 3 part series of Year-End Financial Processes with a discussion on Accounts Payable. See the first 2 here – Contributions and Payroll.

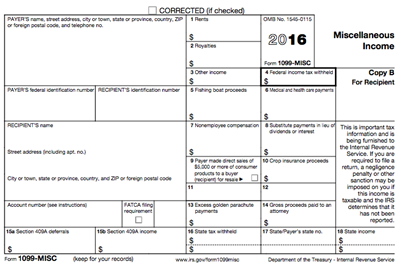

The goal is to issue Form 1099’s to the appropriate individuals and organizations on a timely basis.

Accounts Payable

Perhaps the single biggest thing you can do to help yourself is to become familiar with the 1099 requirements upfront. There are rules as to who receives one and who doesn’t – as well a list of exceptions. Also, understand who is an employee and who is an independent contractor. Then apply these rules to your vendors.

Assuming you have coded your vendors correctly as they were added throughout the year, it pays to print the list based upon vendors coded to receive a 1099. Review the report to ensure vendors on this list should be. It’s just as important to review all other vendors purchased from for the year to make sure no one was missed.

In your review, should you run across vendors that need a 1099, make sure you have a form w-4 on file. For the ones where you don’t, you’ll need to request one asap. Best way is to fax the request. Time is of the essence. Start the review process in early December.

Include credit card purchases in your review process as well.

For churches that don’t use a PO system, print and sort purchases by vendor in order to analyze amounts and what was purchased to use in price, terms, and shipping negotiations. Compare to the previous year and leverage to your advantage.

Adjust procedures as needed for next year based upon your year-end review process.