We’ve been talking about budgeting income for the church. In my previous post, we looked at four steps to budget the number of givers. Today, let’s take a look at budgeting the Amounts Given per Household.

Again, the objective is to show you a practical and simple way to budget tithes and offerings in your church – that are supported by common giving metrics. I’m an advocate of having adequate, measurable support for all budgeted line items, including undesignated tithes and offerings. As I mentioned in this post, everything in the Ministry Plan hinges upon meeting the Income Budget – so, it’s worth the effort to build your income budget using practical, easy drivers of giving.

The advantages of having an income budget built upon components that are measurable are:

a) it’s a good exercise for your Financial Leaders to go through to understand and to be able to articulate to others and

b) it provides a few metrics to track against in the coming year.

Imagine being able to break down budget to actual variances for income into its causes – allowing you to know what to work on and pray about.

Once your team is comfortable with the Expected Number of Givers, then the next step is to get comfortable with the Amounts Given by Household, or by giver. (By getting comfortable, I mean understanding the drivers/components of the giving budget from a numbers standpoint AND a from a faith component standpoint).

4 Steps in Building the Income Budget

1- Obviously, step one is to budget the number of givers covered in this post

2- Obtain the amounts given per giver for the last three to five years

3- For each of these years, calculate the year-over-year change in amounts given per household

4- Based upon the analysis of this data, budget Amounts per Household by budgeting the Expected Change in the Amount per Giver.

That’s it.

If you have received “special” undesignated gifts in any prior years, I would strongly suggest you:

1- Take out the special (large) one-time donations from your historical data and your current year projection.

2- Calculate the percentage of the special gifts to the total without the special gifts.

By doing so you get a Baseline Dollar Budget that excludes special gifts so that you can budget for special gifts as its own line item.

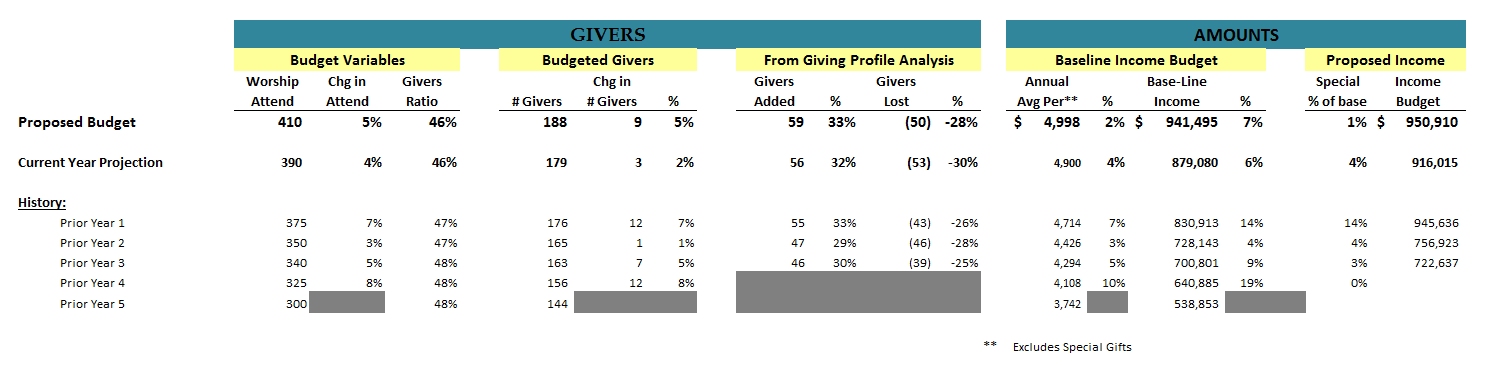

See the below Income Budget Model:

So in the example provided, this church budgeted 188 givers in the coming year – an increase of 9 givers or a 5% increase over the current year’s projection. They expect a 5% increase in attendance while they are expecting their Givers to Attendance Ratio to stay the same.

Based upon prior historical churn rate, they are targeting to return to a 28% rate as a part of their goal to increase giver retention. They have specific plans in place based upon reasons a few givers provided after leaving. So they expect to lose 50 givers in the coming year. This means they will need to add 59 new givers in order to achieve a 5% increase in the number of givers.

On the dollar side of the equation, they are conservatively estimating a 2% increase in their baseline amount per household. The sum result to this point is a 7% increase in the base line income budget. (Receipts with special, large gifts removed – there’s no guarantee these gifts will occur again). So this church is conservatively budgeting another $9,000 in special gifts. Special gifts given or received in the current year are expected to total $37,000. One would think there’s an upside to this budget. [wrote about planning for upsides here]

So at the end of the day they are proposing a $951,000 budget from 188 givers – An increase of $35,000 or 3.8% over current year projected receipts.

To summarize, you have an income budget built upon the following metrics:

1- The # of Givers – based upon Worship Attendance and the Givers to Attendance ratio.

2- Dollars per Household – based upon the percent change in Baseline Amount per Household. The analysis you do here to determine this is up to you, it doesn’t have to be much – I like to take a conservative approach.

3- Budgeted Special Gifts

If you have a Giving Profile Analysis, you can fine-tune these three components by looking at Giving Bands. For example, the givers being added and lost by giving levels, as well as increases/decreases for all others.

Finally, a couple of other considerations before finalizing the budget – Are there any givers giving 10% or more of total dollars, and does Pastor have knowledge of any existing financial leaders that may or will be leaving? Depending on the size of your budget and cash reserves, you may want to adjust accordingly.

In Closing:

Now you have the first part done to enable pre-budget planning conversations with the Pastor.

In my next post, I’m going to talk about taking a leap of faith in terms of budgeting – All about following God’s lead when it doesn’t make financial sense.